Westmoreland’s Canadian entities and Westmoreland Risk Management, Inc. are excluded from the voluntary petitions. Westmoreland’s operations in the U.S. and Canada are cash flow positive and liquidity from operations combined with the Company’s Debtor-In-Possession (“DIP”) financing is sufficient to continue operating its mines in the normal course of business, without any expected impact to current output levels. Importantly, Westmoreland anticipates no staff reductions as a result of the restructuring announcement.

From Westmoreland Coal Company:

Westmoreland Coal Company (“Westmoreland” or “the Company”) (OTCMKTS: WLBA) announced today it has entered into a restructuring support agreement (“RSA”) with members of an ad hoc group of lenders (the “Ad Hoc Group”) that hold approximately 76.1% of the Company’s term loan, approximately 57.9% of its senior secured notes, and approximately 79.1% of its bridge loan. To implement the RSA, Westmoreland today filed voluntary petitions for relief under chapter 11 of the Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of Texas, Houston Division.

In addition, Westmoreland affiliate Westmoreland Resource Partners, LP (NYSE: WMLP) (“WMLP”) simultaneously filed for relief under chapter 11 of the Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of Texas, Houston Division. WMLP has agreed to terms with its secured creditors on the use of cash collateral to fund WMLP’s normal course operations and allow WMLP to serve its customers during the course of WMLP’s chapter 11 case. WMLP intends to continue working constructively with an ad hoc group of its secured lenders (the “WMLP Ad Hoc Group”) in connection with a value-maximizing sale and marketing process that began prior to the commencement of WMLP’s chapter 11 case.

Westmoreland’s Canadian entities and Westmoreland Risk Management, Inc. are excluded from the voluntary petitions. Westmoreland’s operations in the U.S. and Canada are cash flow positive and liquidity from operations combined with the Company’s Debtor-In-Possession (“DIP”) financing is sufficient to continue operating its mines in the normal course of business, without any expected impact to current output levels. Importantly, Westmoreland anticipates no staff reductions as a result of the restructuring announcement.

“After months of thoughtful and productive conversations with our creditors, we have developed a plan that allows Westmoreland to operate as usual while positioning Westmoreland for long-term success,” said Michael Hutchinson, Westmoreland’s Interim Chief Executive Officer. “We will continue to work constructively with the Ad Hoc Group and serve our customers in the normal course as we progress through an expedited process to restructure our long-term debt and other liabilities. Our goal is to emerge as a stronger Westmoreland, better positioned to grow and thrive. We appreciate the ongoing support of our business partners, customers and creditors throughout this process. In addition, we thank our passionate Westmoreland team members for their tireless dedication and commitment to building a stronger Westmoreland.”

In support of the RSA, Westmoreland launched a business transformation aimed at significantly increasing cash flow for all operational and support areas of the business. Initiatives identified by Westmoreland are expected to yield significant annual run rate savings from operational, commercial and overhead efficiencies.

RSA Terms and DIP Financing

The RSA provides that the $90 million outstanding under the Company’s existing $110 million bridge loan facility, which it entered into in May 2018 (the “Bridge Loan”), will be refinanced with a new $110 million DIP facility, of which $90 million has been drawn, subject to Bankruptcy Court approval. The DIP financing and cash flow from operations are expected to provide adequate liquidity to support Westmoreland’s U.S. and Canadian business throughout the restructuring process. The superpriority non-amortizing DIP facility bears interest at the same rate as the Bridge Loan.

Under the RSA, the Ad Hoc Group has agreed to act as a stalking horse bidder to acquire substantially all of Westmoreland’s business assets. Separately, WMLP will continue its sale process.

The RSA addresses Westmoreland’s liabilities, including funded debt and other obligations, and provides the means for it to continue operating in the normal course of business. For additional information, please refer to the Company’s current report on Form 8-K filed along with this announcement.

Both Westmoreland and WMLP have filed “first day” motions with the Bankruptcy Court. When granted, these motions will enable day-to-day operations, regular payment of employee wages and benefits, and payment to key trade creditors for goods and services provided on or after the filing date to continue as usual.

Additional information on the process, including court filings and information about the claims process, is available at www.donlinrecano.com/westmoreland or through Westmoreland’s dedicated restructuring hotline at (800) 499-8519.

Kirkland & Ellis LLP is acting as legal counsel to Westmoreland; Centerview Partners LLC is acting as investment banker and financial advisor; Alvarez & Marsal is acting as restructuring adviser; and McKinsey Recovery & Transformation Services U.S., LLC is acting as an operational advisor. Jones Day is acting as legal counsel and Lazard Freres is acting as investment banker to the Conflicts Committee of the board of directors of Westmoreland Resource Partners, GP, general partner of WMLP.

90 Dogs Rescued in Bloomfield

90 Dogs Rescued in Bloomfield

Resident Dies after House Fire N. of Aztec

Resident Dies after House Fire N. of Aztec

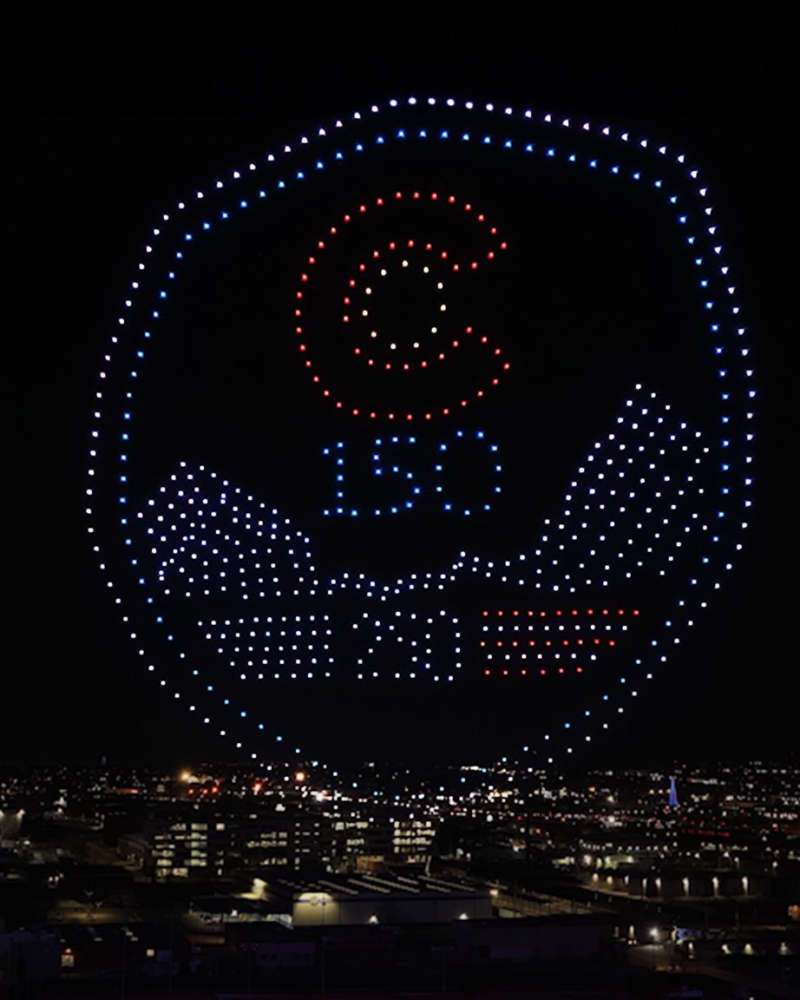

500 Drone Show set for Snowdown Parade Finale Jan. 30th

500 Drone Show set for Snowdown Parade Finale Jan. 30th

Diné College Selects New President

Diné College Selects New President

Lanier Announces 2026 run for NM Governor

Lanier Announces 2026 run for NM Governor

2024 Election: San Juan County Contested Races

2024 Election: San Juan County Contested Races